When it comes time to pay back the loan (and attached fees), they often have to take out another payday loan, and suddenly they are on a vicious cycle. Many consumers eventually reach a breaking point in the cycle and fail to pay back a loan. Then the real trouble begins. Michigan consumers who default on payday loans are often hounded by aggressive debt collectors. After this, their already damaged credit scores are utterly destroyed. This just makes it even more difficult for these consumers to repair their bad credit and get back on track with their finances.

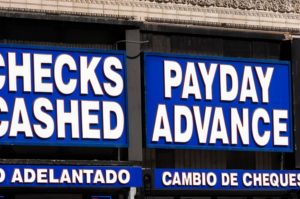

Guidelines for Payday Lenders in the State of Michigan

As mentioned before, payday lenders are governed by strict rules in the state of Michigan. Unfortunately, this doesn’t mean that they always follow the rules, but payday lenders that violate the Deferred Presentment Service Transactions Act (DPSTA) are penalized.

In Michigan, payday loans may not exceed $600, and loan terms are limited to 31 days or less. There are also caps on fees and finance charges. For example, the maximum finance charge on a 14-day, $100 payday loan is limited to $15. Keep in mind, though, that this represents a 391% APR, which is incredibly high. To put it in prospective, the average APR for high-interest credit cards is normally 25-30%.

Payday lenders are not permitted to issue more than one loan at a time. Michigan consumers with an open payday loan may seek and additional loan from a different provider, but that’s it. They are not allowed to carry more than two payday loans at a time. Of course, this doesn’t mean that payday loan borrowers can’t get a new payday loan the second the old one is paid off. In fact, so many Michiganders habitually take out payday loans that a special rule is in place for repeat customers. If a consumer takes out eight payday loans within a 12-month period and finds that they are unable to pay, they may ask for an installment plan. Naturally, though, this “service” comes with additional fees.

Abuses and Violations Committed by Michigan Payday Lenders and Debt Collectors

Again, not all Michigan payday lenders follow the regulations established by the DPSTA. These unscrupulous sharks rely on their customers not knowing the rules. This is why it is important for all Michiganders to understand how payday loans work. They should also know their legal rights as payday loan borrowers.

Sadly, Michigan consumers run into the biggest problems when they fail to pay off their payday loans. At this point, they are normally turned over to aggressive debt collectors or find themselves at the mercy of the payday lenders themselves. Michiganders who default on payday loans are often relentlessly harassed and sometimes threatened with wage garnishment or even jail. Because bank account information is required for payday loan approval, payday lenders use this to their advantage. In fact, it isn’t unusual for payday loan defaulters to wake up to drained checking accounts.

Not every debt collector is shady and abusive, but a lot of the ones that are work for payday lenders. Here, the worst debt collectors in Michigan think that they can get away with just about anything. However, these debt collectors are still bound by the Fair Debt Collection Practices Act (FDCPA), the federal statute that protects consumers against debt collector harassment.

Therefore, if you are threatened, harassed, humiliated, or otherwise abused by a debt collector over a payday loan, you don’t have to take it. Sometimes Michigan consumers are pursued for payday loans that don’t belong to them and intimidated to the point of paying money that they don’t owe. This should never happen. Instead, if a debt collector is wrongfully hounding you for payment or making you feel uncomfortable in any way, call Michigan Consumer Credit Lawyers.

The Free and Legal way to Stop Debt Collector Harassment

Don’t let debt collectors or collection agencies get away with illegal actions. At Michigan Consumer Credit Lawyers, we’ve stopped debt collector abuse since 2008. We make the debt collector pay you. Our services cost you nothing. How do we do it? All of our fees come from the defendants in settled cases. This is why our clients pay nothing for the work we do.

Let’s start the conversation about what we can do to stop debt collectors from harassing you. Call us today at (248)353-2882 or contact us via our website.